In March 2024, the IESO released their annual planning outlook. The following are some thoughts derived from a read of the Outlook.

Uncertain Demand

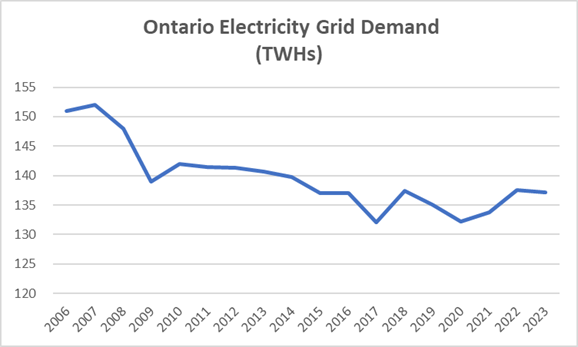

The first challenge facing the IESO is the uncertainty in future demand. Since the recession of 2008, demand for electricity has been either flat or falling (Chart 1). This has now changed and demand is starting to rise again. Most of the increase in demand so far has been from industrial demand but the electrification of transportation and heating is expected to be a big driver going forward. The IESO has total demand increasing by 60% to 2050 (Chart 2).

Peak demand is expected to rise in a similar fashion from its current level of under 25 GW to over 35 GW by 2050.

The problem is, while nobody knows if this projection understates or overstates the future demand, the IESO and the Government of Ontario are responsible for ensuring that any future demand is met.

Nuclear Power

To meet this obligation, the Government of Ontario is largely betting on nuclear power. The following nuclear power investments have been made or are being complemented.

| Investment | MW | Type | In Service | Cost | Status |

| Bruce Power | 4,800 | New plant | 2040? | Unknown | Proposed |

| Bruce Power | 7,000 | Refurbishment and 30-35 year life extension | In stages to 2033 | $13 billion | Ongoing |

| Darlington | 3,500 | Refurbishment and 30-35 year life extension | In stages to 2026 | $12.8 billion | Ongoing |

| Pickering | 2,000 | Refurbishment and 30-35 year life extension | In stages to 2035 | Unknown | Announced |

| SMRs | 1,200 | New plant | Four units by 2035 | $8.4 billion | Ongoing |

There are several reasons why Ontario is betting on nuclear power:

- The cheapest and most reliable form of power is hydro but the availability of new hydro sites in Ontario is limited.

- Nuclear power is carbon free.

- Nuclear power is baseload power which means it is available all the time. This is not the case with solar and wind. Solar and wind can only be made into baseload power with the addition or storage but at current costs this makes them uncompetitive. Solar and wind are also not reliable enough in Ontario winters for this to work.

- The costs of nuclear power are known given Ontario’s experience. The current cost is around $0.10 per kwh.

- Ontario has a competitive advantage with nuclear power given the long experience and, more importantly, the recent investments while other economies were downsizing their nuclear power.

- Ontario has a competitive disadvantage with solar and wind power due to geography.

The biggest challenge with nuclear power is the long history of nuclear projects having double or triple their projected costs. Those responsible for the implementation of these projects must be held accountable.

Solar and Wind Power

This does not mean that Ontario is ignoring solar and wind power. There will be three roles for solar and wind power. The first is a source of cheap power to supplement the base load nuclear power. These can be the large solar and wind installations that are grid connected. The second will be distribution grid connected solar and wind power to help meet local demand conditions. More on this below.

The third will be as the source of cheap power to match with energy storage to try to replace gas generation. Ontario currently uses gas generation for peak loads. Peak power is always the most expensive as it is only needed a few times a year. Even gas generation, which is generally quite cheap, is expensive for peaking purposes as the gas plants are only used sporadically. While solar and wind power matched with energy storage is too expensive for base load power, it may be competitive for use as peaking power.

One of the exasperating aspects of the IESO forecasts is that they display capacity availability based on the contract terms. While this is understandable it does tend to overstate the future challenge. The hydro, solar and wind infrastructure will still be there and their owners will want to generate a revenue stream. The IESO is aware of this and has plans to offer contract extensions; just at lower rates. The gas plants will also still be there if needed.

Transmission Challenge

There are two downsides to the nuclear option. The first is that each investment is huge and has a long lead time. If we wait to ensure the demand will be there then it will be too late, the investments must be made well ahead of the demand. This creates the risk of investments in generation for which there is no demand. Given the unsatiable demand for energy and the fact that a use can always be found if the energy is there, I am less worried about this risk.

The second risk is the continued need for large transmission infrastructure as the current model of a few locations generating most of the power and using the transmission grid to transmit it around the province is maintained. A 60% growth in electricity demand will need an equivalent increase in transmission; all else being equal. The planning outlook recognizes this but does not really have a solution other than that more planning is needed.

This challenge is exasperated by the fact that growth will not be even and may not be locally forecastable for more than a couple of years. The current hot spot is Southwestern Ontario due to the demands of the greenhouse and auto industries. While the greenhouse demands have been growing for many years the recent auto industry announcements are very new and could not have been forecast. Five years from now the hot spots maybe a different part of Ontario.

In NOTL Hydro’s opinion there are three solutions to this challenge.

- The first will be more transmission infrastructure. In some areas, like in Southwestern Ontario this should be very doable. In other areas, like downtown Toronto, this may not be possible.

- SMRs (small modular reactors) can be part of this solution. Their comparatively smaller size (50-300 MWE) means they should be able to be located in multiple locations to offset the need for transmission. However, these are still nuclear reactors so this flexibility is limited by both safety concerns and public acceptance (would an SMR be accepted in Oakville?).

- LDCs have been promoting the concept of being allowed to become Distribution System Operator (DSO). This would provide the LDC with the authority to create local solutions, like local solar and wind power, virtual grids or local markets where the local demand cannot be fully supported by the transmission grid.

Conclusion

In summary, in the short term the planning outlook expresses some concerns as the supply of electricity could be tight if demand rises sharply. In the medium term, with the planned investments in the nuclear plants, the IESO is less concerned. In the longer term the IESO really has no idea and the solutions are still a work in progress.