PULSE

Last month the Minister of Energy and Mines announced the formation of a panel to review the electricity distribution sector and make recommendations. The panel is called the Panel for Utility Leadership and Service Excellence (PULSE). The areas of focus for the panel include:

- Operational performance and customer service

- Financing gaps for critical infrastructure investments

- Sustainable investment in municipally owned utilities

- Ownership, governance and investment models for municipally owned utilities

- Cost reductions through shared services

- Connection timelines

- Grid modernization

There are some interesting features about this panel.

- Prior to the announcement of the panel, the Minister released an Opinion Editorial that was printed by the National Post. The Op Ed focused on potential investment challenges at municipally owned utilities. This is very unusual.

- The panel was given a very short timeline of 100 days. There will be no hearings and the panel is to rely on previously published reports as well as submissions which are due in December.

- I would consider the panel deep in knowledge but not broad in experience. Three of the four panelists have backgrounds with either Alectra or Toronto Hydro; the two largest municipally owned utilities.

Most knowledgeable people I talk to believe these features are an indication that the Minister has a clear objective and that the panel is a means to this end. Most also believe that the objective is related to allowing more private investment into the municipal utility sector. Why the panel is needed is unclear. It could be to support tax discussions with the Federal Government or to provide support for what they feel may be an unpopular decision.

One of the peculiarities of municipally owned electricity distributors is that all of their taxes are paid to the provincial government. Taxes are calculated just like any business but instead of payments to both the federal and provincial governments, it all goes to the provincial government. Once private sector ownership crosses 10%, this changes and the tax payments go to both governments like a normal business. There are also potential capital tax implications at this point which are known as a departure tax. This tax issue has helped restrict private investment into municipally owned utilities.

I do not know if dealing with this particular issue is the ultimate objective. It makes sense as both the op ed and the PULSE announcement included much discussion of the need for more investment in municipally owned utilities due to electrification. If this is the case, I have no issue with it. There are a number of positives for increasing private investment in municipally owned utilities. The only caveat is that it must be voluntary. Not all the municipally owned utilities will need or want this investment. So as long as they continue to exceed reliability and service standards, which I predict they will, they should be allowed to continue as being fully owned by the municipality. One of the negatives of increased private investment is likely to be higher rates.

Consolidation

One of the byproducts of creating uncertainty is people start fearing the worst. For municipally owned utilities, the fear is that they will be forced to consolidate. This fear is not unfounded. The provincial government has consistently promoted consolidation in its publications, has legislated numerous tax policies to promote consolidation and had required the utilities to discuss what they are doing about consolidation in their rate filings.

I do not believe that this is the objective. If it is, it will be a big mistake. The best possible evidence as to why this would be a mistake was just published.

Alectra is the largest municipally owned utility in Ontario. It has over 1 million customers and includes the large municipalities of Markham, Vaughan, Richmond Hill, Mississauga, Brampton, Hamilton, St. Catharines and Guelph plus a number of others. The whole argument for consolidation is that efficiencies from scale should result in lower rates for customers. If any utility should achieve these efficiencies, it should be Alectra.

The Ontario Energy Board (OEB), in a further promotion of consolidation, allows consolidated utilities 10 years in which they do not have to file a full cost of service rate application. The rates basically just increase with inflation during this period. The idea is to allow the utility to keep the benefits of consolidation for ten years in higher earnings before returning it to their customers in lower rates.

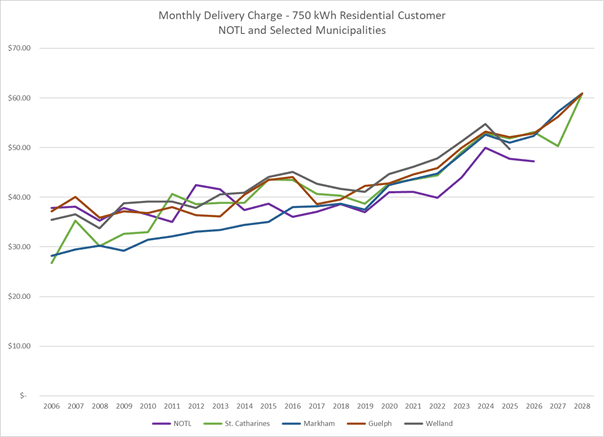

The following chart shows the rates since 2006 for three of the Alectra municipalities (Markham, St. Catharines and Guelph) and two much smaller Niagara utilities (Niagara-on-the-Lake and Welland). Alectra just filed their 10 year cost of service and are proposing to harmonize their rates in 2028. I have shown their rates including their proposed 2026, 2027 and 2028 rates. For Welland, I only have their actual rates to 2025 and for NOTL I have included the 2026 proposed rates.

The chart shows that in 2025, the rates were lower in both Welland and NOTL. It also shows that there will be no permanent rate reduction for Alectra customers. St. Catharine’s customers get a one-year reduction in 2027 but return to the higher harmonized rates in 2028.

As mentioned, if any customer should be seeing the benefits of consolidation, it should be a customer of Alectra.

I should note that the rates from 2026-2028 for both Alectra and NOTL Hydro are proposed and still need to be approved. In the case of Alectra, the process is still at an early stage and there are likely some adjustments down in the proposed rates. This will not change the underlying argument.

The Alectra rate filing does have a section in which it describes all the savings that have been realized from the consolidation. I do not question these. However, from experience I know that there are other pressures increasing costs. These include higher salaries for management now that they are managing bigger teams, increased layers of management and increased costs to manage a large and widespread business. These costs are not insignificant, arise naturally over time, and can easily offset the actual savings.

I am not disparaging Alectra with these observations. I am a customer of theirs in St. Catharines and have few complaints. The complaints I do hear about Alectra are typical of those of any large organization. That is, they have lots of good and knowledgeable staff, but their processes can also be bureaucratic, slow and impersonal.

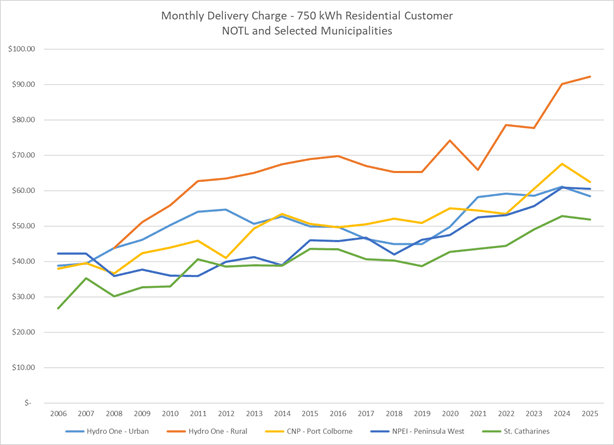

Alectra’s rates also compare favourably to some other consolidators like Hydro One, CNP and NPEI as shown in the chart below. I used the St. Catharines rates as the proxy for Alectra.

Finally, I have nothing against mergers and acquisitions. A shareholder should always have the right to sell their investments. There are some mergers taking place right now that make perfect sense and many of the current municipally owned utilities are the products of mergers. What I am against is this notion that further consolidation is needed to lower rates and improve service quality. The facts show that this is not the case. Can we not instead celebrate the benefits of having different approaches, be rid of this notion that one solution is the best for all our customers and remove all the challenges the provincial government tries to make to encourage consolidation.