In October, the Minister of Energy and Mines released an Opinion Editorial that was printed by the National Post. Stephen Lecce: Ontario utilities are heading towards a financial cliff | National Post

The Op Ed focused on potential investment challenges at municipally owned local distribution companies (LDCs) due to the expected growth in the demand for electricity over the next twenty-five years. The Minister then appointed a panel to provide a report on a number of topics but which appeared to be largely focused on recommendations around getting investments into LDCs.

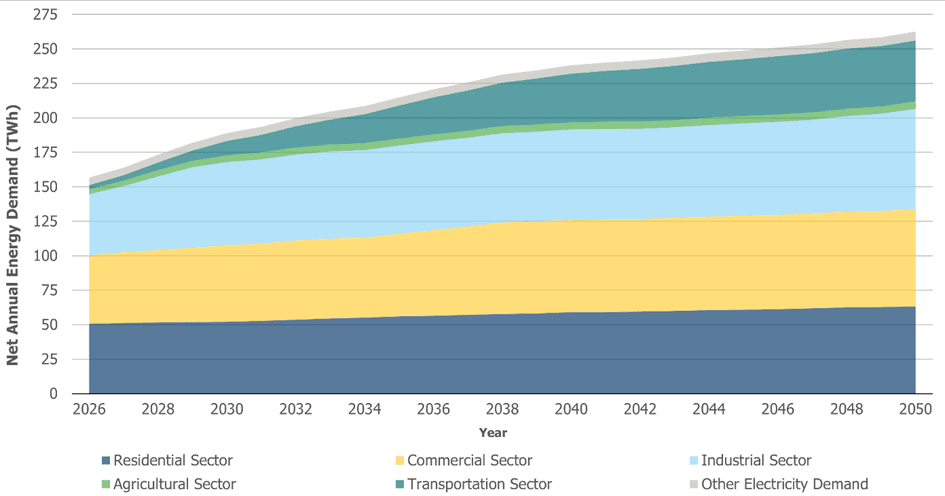

Driving this concern is a forecast by the IESO of a 75% growth in the demand for electricity by 2050 as shown in the graph below.

However, growth in electricity demand does not necessarily lead to a correlated growth in the investment requirements of LDCs. I have no concerns with, and would welcome, enhanced opportunities for investments into LDCs. Whether they are needed or not would be up to the LDCs themselves and their current owners to determine. For the rest of this blog I would like to analyze this LDC investment requirement a little deeper and then posit an alternative possibility for the Minister’s concern.

The IESO identified a number of factors driving the increase in the demand for electricity. I have listed a number of them below. The categories are of my making.

| Electricity Demand Factor | Connection Investment Attribute |

|---|---|

| Mining and processingSteel electrification (electric arc furnaces)Data centres | Very localized with significant specialized connection costs and requirements |

| Industrial production Greenhouses | A mix of widespread and localized with varying connection requirements |

| Residential and commercial electrification (heat pumps)Transportation electrification (EVs) | Widespread but largely using existing connections |

| Population growth | Widespread and new connections |

The first category above are potential very large electricity users but that will only be in specific locations. Mines and mineral processing facilities tend to be located in very rural areas so will require special purpose connections. Their demand requirements also mean they will likely be connected to the transmission grid. Steel facilities are also few in number and will need special connections. Algoma Steel needed a new transmission line to service it when it switched to an electric arc furnace. Data centres can go anywhere but their needs are so large that the any connection issues will be at the transmission level. I talked to one broker for data centres and he indicated a minimum size requirement of 100 MW. Even if data centres are distribution-connected, the high cost issues about getting them connected will all be transmission related. In short, these are big drivers of the growth in electricity demand but are unlikely to have much of an impact on LDC investment requirements. Where they do, it will be in one-off situations that can be managed separately.

The electrification of heating and transportation are also expected to be big drivers of the increased demand for electricity. However, there are two reasons while the impact of these two electricity uses will not be considerable on the investment needs of LDCs. The first is that the vast majority of the customers that will be using these technologies are already connected. There is very little in the way of connection work for the LDCs. What may be needed is upgraded infrastructure to manage the higher demand from these customers. This could include larger transformers and increased wire sizing. This brings us to the second reason why the impact on the investment needs will be low. The impact of this transition will take place over the full twenty-five years. Generally, residents and businesses will only transition to EVs and heat pumps when they need a new vehicle or a new HVAC system. Given this time horizon, the investments needed by the LDCs should be very manageable.

Population growth will also drive up demand as this leads to new housing, new businesses and new connections. However, the forecasts for population growth are no different, if not less, than what they have been for the past few decades so this should not really be an issue from an investment perspective.

I skipped industrial production and greenhouses as these do have the potential to require significant investments by the LDCs. I was at a conference recently where a Niagara industrial customer (unfortunately not in Niagara-on-the-Lake) talked about needing 5 MW in the near future. In Niagara-on-the-Lake, we have seen the growth in demand for electricity from greenhouses, though nothing like what is happening around Leamington. The electricity requirements of the new plants related to EVs have been well documented. However, when you talk to the management of LDCs that have been impacted by these loads, the issue is not the investments in the distribution grid required to serve these loads, the issue is the transmission connections. The investment constraints are to install new transmission stations or new transmission-grade connecting lines. The current rules already provide scope for these types of investments by third parties.

Two other factors to consider with regards to LDC investments needed to manage growth. One, which I have mentioned, is that these investments can be made over much of the 25 year time horizon. They do need to be made in advance, so require active planning, but they do not need to be made all at once. The other factor is that growth in demand creates revenue streams. These investments will be largely self-financing. As long as the upfront capital is there, and I have demonstrated that this is less than is being argued, then there should be no issue.

There are two other demands for investments by LDCs that do not create their own revenue stream. The first is DERs. More and more customers are installing DERs for their income or to offset their cost of energy. These installations create challenges for LDCs in their local grid management. LDCs receive little revenue from these DERs but have the expense of the grid management.

The second, and bigger of the two, is the demand for improved reliability by all customers. The digitization of many aspects of daily living is substantially increasing the impacts of outages and reducing customer’s tolerance for them. LDCs must invest in smarter grids and grid strengthening to meet these demands.

The investments for both these demands are ones that can be done over time. Most LDCs have already begun to make these investments so are well on their way to managing them without being too stretched financially.

In summary, I believe the increased demand the IESO is forecasting will not create an undue burden on the investment requirements of LDCs. It will require significantly more generation, which the Province is proactively engaged in, and significantly more transmission. I have often argued that it is the transmission aspect that concerns me more in terms of the Province’s ability to meet this growth in demand.

While I have argued that the future investment requirements of LDCs should be manageable, this will depend on their ability to borrow. One of the biggest factors affecting any company’s ability to borrow is its existing debt load. A way to measure this is the debt:equity ratio. This compares the amount of debt in a company to its equity. Using this measure also allows for comparisons of LDCs of different sizes.

The following are the debt:equity ratios of the five largest municipally owned LDCs plus Hydro One per the 2024 OEB Yearbook.

| LDC (ranked by size) | Debt:equity ratio |

|---|---|

| Hydro One | 1.99 |

| Toronto Hydro | 1.26 |

| Alectra | 1.31 |

| Hydro Ottawa | 1.88 |

| Enova | 0.55 |

| Elexicon | 1.62 |

The average debt:equity ratio for the Ontario LDC industry is 1.44. If Hydro One is removed, as a publicly traded company their access to investment capital is different, the average industry ratio falls to around 1.2. Four of the five largest municipally owned LDCs have debt:equity ratios above the industry average. By comparison, NOTL Hydro’s debt:equity ratio is 0.64 and the average of an industry association of smaller LDCs is 0.95.

There are two possible, complementary, explanations for this difference in the debt profiles between the larger and smaller LDCs. One is that size is a benefit when it comes to managing debt as there are move avenues for borrowing available and a higher debt ratio can be managed. I do not dispute this. The other is that the shareholders and Boards of these larger LDCs have provided direction, possibly by the dividend policy, that has resulted in the higher ratios. The news that both Toronto Hydro and Elexicon have recently amended their dividend policy would appear to bear this out. At NOTL Hydro, and at many other smaller LDCs, the direction from the Boards and Shareholders has been to keep debt low so that the funds will be readily available if needed.

Maybe the issue is less one of onerous future capital investment requirements but one of LDCs having appropriate financial policies to fund higher, but still manageable, investment requirements.