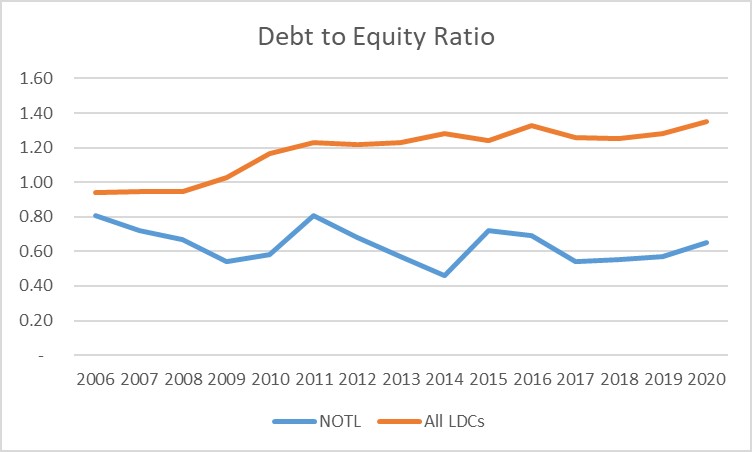

NOTL Hydro funds its capital work through rates, debt and retained earnings. Strategically, the Board of NOTL Energy likes to keep the debt of NOTL Hydro low. This can be seen in the chart below. NOTL Hydro’s debt-to-equity ratio is much lower than the average of all the electricity distributors in Ontario. The Ontario Energy Board considers a debt-to-equity ratio of 60:40 or 1.50 to be acceptable in general though electricity distributors are meant to adjust this based on their personal circumstances. The average debt-to-equity ratio of electricity distributors of 1.35 is getting close to this. NOTL Hydro’s debt-to-equity ratio in 2020 was 0.65.

This low debt strategy has a number of benefits, such as low interest rates and cost, but the biggest one is flexibility. Electricity is an asset intensive business. Some major investments, such as when we install new transmission grade transformers, can be scheduled but others, such as the Government of Ontario requiring smart meters for all customers, cannot. NOTL Hydro must ensure it always has the ability to borrow the necessary funds to make these investments.

NOTL Hydro is also, relative to this industry, a small company. We do not have a credit rating and are not big enough to issue bonds or tap the capital markets. To borrow we need to have an agreement with one of Canada’s banks. To know that we can borrow in a time of need, we need to ensure we are in solid financial shape.

Due to the low level of our borrowing, the consistent nature of our business and our history of repaying debt, NOTL Hydro has been able to establish a strong relationship with one of the big Canadian banks. We have multi-million dollar facility that can be drawn when needed. Just because you have access to these facilities does not mean you have to use them but it is good to know they are there in case they are needed.