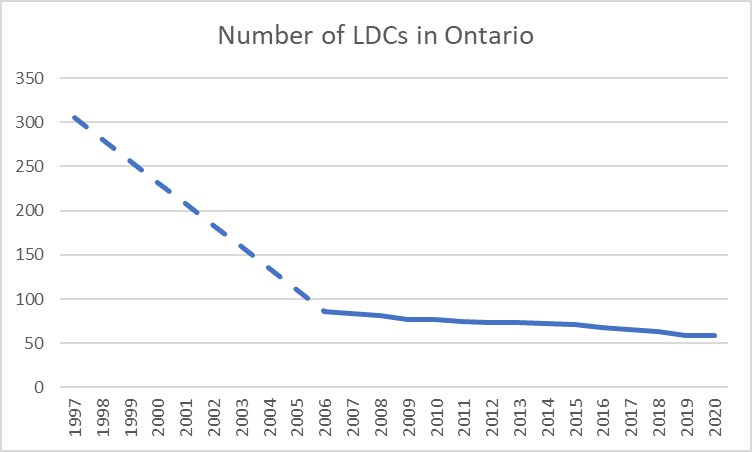

I have mentioned that prior to the passage of the Electricity Act, 1998 there were over 300 electricity distributors (LDCs) in Ontario. I count 305 in 1997. At the end of 2021 there were 59. This blog is my take on how this industry consolidated.

Prior to the Electricity Act, 1998, the individual electricity distributors were Commissions. As such, though they were highly connected to their municipality they were not “owned” by the municipality and could not be sold. They probably could have merged but there was no incentive to do this. After the Electricity Act, 1998 the electricity distributors became incorporated companies. This means they could make a profit, pay dividends, pay taxes, raise debt and have their shares sold or the companies merged just like a regular business.

There is also an important difference between the sale of an LDC and its merger. For instance, Thorold sold their LDC to Hydro One many years ago. This means they received the full value of their LDC at that time in cash but have no further say in its operations nor receive any future financial benefits. Many sellers of their LDCs were either attracted to the cash payment they would receive or needed it for some other critical purposes. St. Catharines merged with Hamilton to create Horizon and this subsequently merged with other LDCs to create Alectra. No payment of cash for the shares was received by St. Catharines. St. Catharines has only some limited say in the operations as it has one Board seat. However, they also own around 5% of the very large Alectra, continue to receive dividends and continue to own shares that increase in value and could still be sold.

Initial LDC Sales to Hydro One

In 2000-2001 Hydro One purchased 87 LDCs. One more was purchased in 2007. Most of these LDCs were very small with an average size of around 1,600 customers and 140 thousand customers in total. There were some larger LDCs included in these purchases including Thorold, Owen Sound and Brockville that had closer to 10,000 customers each. Most of these LDCs (or rather their municipalities) made the justifiable determination that the LDCs could not survive on their own with the new operational and regulatory requirements from the Electricity Act, 1998. Many of these were also “virtual” LDCs. They had created the Commission and purchased the assets from Ontario Hydro so that their rates were lower but had outsourced all the operations back to Ontario Hydro. They had no staff to operate in the new environment.

With hindsight, we can state that the decision to sell to Hydro One was not the best financial decision compared to alternatives. As can be seen with an analysis we prepared back in 2017, http://www.notlhydro.com/wp-content/uploads/2017/09/Analysis-of-Hydro-One-Acquisitions.pdf, these municipalities have had much higher rates than they otherwise could have.

Small LDC Mergers

Many small LDCs decided that instead of selling they would merge to achieve the economies of scale needed to survive. Some of the examples of this include Entegrus (17 LDCs), Westario (15 LDCs), ERTH (11 LDCs), Lakeland (6 LDCs), ELK Energy (6 LDCs), Essex (4 LDCs), Rideau St. Lawrence (4 LDCs), Ottawa River Power (4 LDCs) and Northern Ontario Wires (3 LDCs). In these cases, each of the original LDCs was very small so the resulting amalgamated LDC is still not large; but it is large enough to operate successfully. These LDCs tend to be regional in nature and are located in a distinct part of Ontario but there is not one municipality that dominates ownership and control. They also have rates that are much lower than Hydro One. Some of these smaller merged LDCs are, in my opinion, the most innovative and entrepreneurial of LDCs in Ontario.

Regional Hubs

Another consolidation approach has been the merger of smaller LDC with a large neighbouring LDC to create a regional LDC. Here in Niagara NPEI (Niagara Peninsula Energy) is the merger of Niagara Falls, Lincoln, West Lincoln and Pelham but Niagara Falls remains the majority owner. A similar situation exists around Sarnia with five small local LDCs having merged with the dominant Sarnia to create Bluewater Power. A variation of this also occurred in Toronto and Ottawa though in these cases the merger was forced through the municipal amalgamation and preceded the Electricity Act, 1998. More recently some other regional hubs are emerging. The LDCs of Kitchener and Waterloo are merging and Cambridge, which had previously merged with some of the smaller surrounding LDCs, has now merged with Brant County and Brantford to create GrandBridge Energy.

Hydro One Purchase of Larger LDCs

Over the past ten years, Hydro One has purchased five larger LDCs of Norfolk, Haldimand, Woodstock, Orillia and Peterborough. These had a combined customer base of around 105 thousand. NOTL Hydro, along with some other LDCs, intervened in the first of these, the purchase of Norfolk, arguing that Hydro One’s history of large rate increases meant this would not be in the best interest of their customers. Through some rather convoluted logic the OEB approved the purchase stating that past rate increase performance is not an indication of future performance. After a promised five-year moratorium Hydro One applied for a large rate increase; consistent with their past performance. The OEB did not approve this rate increase. This has left Hydro One not fully able to integrate these LDCs and harmonize their rates as they would like and the OEB having to consistently monitor this part of Hydro One separately.

Large LDC Mergers

There are two LDCs which have been created by the merger of several large LDCs. The service territories of these LDCs tends to be more geographically dispersed and there is no dominant shareholder. Alectra is the largest of these by far and has over 1 million customers. It is made up of 17 former LDCs including previously very large ones such as Mississauga, Brampton, Markham, Barrie, Richmond Hill, Vaughan, Guelph and St. Catharines. It is the largest LDC in Ontario after Hydro One. Elexicon is the other though much smaller at around 170 thousand customers. It is also made from 17 LDCs including those in Oshawa, Pickering, Ajax, Whitby, Belleville and Gravenhurst.

Non-Ontario Municipal Ownership

Besides Hydro One, there are other non-municipal investors in the LDC sector in Ontario. Fortis, a publicly traded Canadian company is the largest of these. (Disclaimer: I worked for Canadian Niagara Power from 1998-2004 during which they went from being 50% to 100% owned by Fortis.) They amalgamated and own LDCs in five municipalities or areas and are heavily involved in a new transmission line being built to supply indigenous communities. EPCOR, which is a municipal LDC but of Edmonton, Alberta, owns the LDC in Collingwood. OMERS used to own 10% of Enersource in Mississauga so now owns a sliver of Alectra. Most recently, Enbridge, which previously purchased and then sold Cornwall Electric, announced it was purchasing 10% of Oakville Enterprises. While some of the practices of this ownership can increase rates, it can also bring in new innovations, practices and viewpoints from elsewhere which is beneficial.

Standalone

Finally, there are the LDCs such as NOTL Hydro that have decided not to merge, sell or buy. These range from small LDCs with a little over 1 thousand customers to London Hydro with over 160 thousand customers. Generally, if you have remained standalone over the past 20 plus years, you have a municipality that recognizes the value of continuing to own your local LDC and has been able to avoid the temptations of easy cash. You also have a Board and management team that has been able to operate the LDC successfully so that a merger was not required.

Conclusion

The Government of Ontario has been promoting the consolidation of the LDC sector. This has been done through tax breaks and other carrots rather than mandating it. The Government continues to believe there are economies of scale from these amalgamations even though there is no empirical evidence demonstrating this. I believe this is a mistake. There are benefits from the diversification of having many LDCs. This can be seen in the different ways individual LDCs have evolved over the past 20 years providing different benefits for their customer or ownership base. This, and the innovativeness of the smaller LDCs, would be lost if you only had a few large LDCs. I expect the number of LDCs to continue to decline slightly over time as municipalities decide a merger would be better for their customers or they want the proceeds from a sale. However, let’s not have unnecessary Provincial incentives trying to influence this natural process.

Great blog! Very informative on the evolution of the LDC’s in Ontario. I agree – lets not lose the innovation and diversity that the current players bring to the market. Nor should the Province be incenting to reduce the number of providers – let that happen naturally.